Select a Fortune 500 company. **APPLE***

-Imagine your manager has asked you to help with a presentation on the company’s financial performance at the company’s annual meeting.

-Research financial information and key performance indicators for the company.

Information is for investors to assess the company’s financial growth and sustainability.

Identify key performance indicators for the company you selected, including the following:

• The company and its ticker symbol

• Cash flow from operations

• Price-to-earnings ratio

• Stock dividends and the yield, if any

• Earnings per share ratio

• Revenue estimates for the next 12 months

• Revenue from the previous 3 years

• Statement of cash flows and identify net cash from operating, investing, and financing activities over the past 3 years

• Average trade volume.

• Current stock price, 52-week high, and 1-year estimated stock price

• Analysts’ recommendations for the stock [buy,sell, hold]

• Market cap for the company

Relate the stock price to price-to-earnings ratio.

Explain the market capitalization and what it means to the investor.

Evaluate trends in stock price, dividend payout, and total stockholders’ equity. Relate recent events or market conditions to the trends you identified.

Determine, based on your analysis, whether you think the organization is going to meet its financial goals, the outlook for growth and sustainability, and explain why you recommend this stock for purchase.

**Please use subheadings for topics**

**use as reference if possible: Brealey, R., Myers, S. C., Marcus, A. J. [2020]. Fundamentals of corporate finance [10th ed]. McGraw-Hill Education: New York, NY.

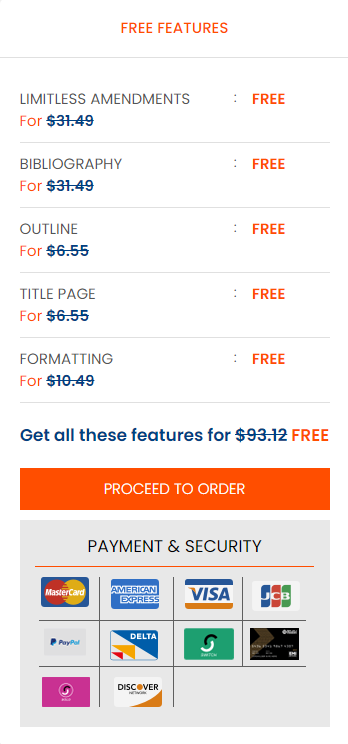

NEED A PERFECT PAPER? PLACE YOUR FIRST ORDER AND SAVE 15% USING COUPON:

Legal

Terms And Conditions

Refund Policy

Privacy Policy

Other

How Our Service is Used:

Our essays are NOT intended to be forwarded as finalized work as it is only strictly meant to be used for research and study purposes. We do not endorse or condone any type of plagiarism.

© 2022 Custom Essay Expert. All rights reserved.